Breaking it Down: Understanding Confusing Financial Aid Letters

The most important part of committing to a college/university is fully understanding what you’re getting yourself into financially.

We walk you through the two major questions to ask yourself when evaluating whether the loans offered to you are reasonable.

EXAMPLE: You may have to do the math yourself, because a financial aid letter doesn’t always tell you everything.

EXAMPLE: All financial aid letters look extremely different, so we walk through two letters that one student received and how to compare the awards.

Use our checklist of everything you need to look for and understand before committing to a school.

Read more tips on navigating the college process on our blog!

Breaking Down Example Financial Aid Letters to Help You Understand Your Award

Making the decision is difficult!

You’ve made it through applications, been accepted, and received your financial aid award. Now is the most difficult part: committing to a school. You need to understand exactly what you’re committing to - especially financially - and there are hidden implications in financial aid awards that many families are totally unaware of. Alyssa the SAT Expert explained how to analyze your financial aid packages in this video blog post, and in this video she’ll walk you through two real examples of financial aid packages and exactly what they mean, so that you can break down your own financial aid award like an expert.

Loans: everything you need to know

Subsidized vs. Unsubsidized

Subsidized is always better. Loans that are subsidized by the government do not begin accruing interest until 6-9 months after you graduate. Unsubsidized loans begin accruing interest immediately, meaning you end up paying back much more than the initial dollar amount of your loan. Make sure you know your interest rate - some loans may charge a massive amount of money, so your $2,000 unsubsidized loan ends up being more of a $3,000 loan.

Loan Cap

We strongly recommend avoiding over $5,500 in loans per year. That is already much higher than we like to see, but many colleges offer more than this in loans per year. Make sure you understand whether the loans you see are per semester or annual, add up how much debt you’ll be in at the end of four years, and ask yourself whether it’s reasonable for you.

Example One: Gaby, Union College

One student, Gaby, went to Union College. Her award letter added up the total cost of attendance clearly at the top, then followed with the total amount of money being given to her each year.

Everything in her letter that says “scholarship” or “grant” is free money - that’s great!

Next up is loans; her loans are subsidized and only $3,500 per year - that passes both tests of loans!

Finally, her work study is $1,600 - a totally reasonable amount to work over the course of a year.

Note: Gaby’s award letter looks a little different than many because her school operates on a trimester system. Remember that every school is a little bit different, and pay attention to the details.

What the award letter didn’t tell her

Gaby’s award letter left out one crucial thing: when you compare the total cost of attendance and the money given through scholarships, loans, and work study, there was $1,000 missing. Nowhere in the letter did it point out that Gaby’s family was expected to pay $1,000. The takeaway? Make sure you do the math. If you aren’t sure why something doesn’t add up, just ask the financial aid office.

Example 2: Miguel, Alfred University and Mercy College

Miguel was admitted to both Alfred University and Mercy College. Here is a comparison of two very different award packages, and what each of them really means.

Alfred University

Alfred University noted Miguel’s cost of attending as $52,672. Alfred included housing and meals in that total, which is great! Not all colleges will factor housing and meals into cost of attendance, so make sure you identify whether that is covered in your offer and, if not, ask the financial aid office how much you can expect housing and meals to cost.

Miguel received over $33,000 in grants and scholarships, which left the net cost of $19,512.

$5,500 in loans were offered, which passes our rule (just barely). However, $2,000 in those loans are unsubsidized and will accrue interest right away.

$2,000 in work study was offered - totally reasonable!

All of this left $12,012 to pay - even though Miguel’s expected family contribution was zero.

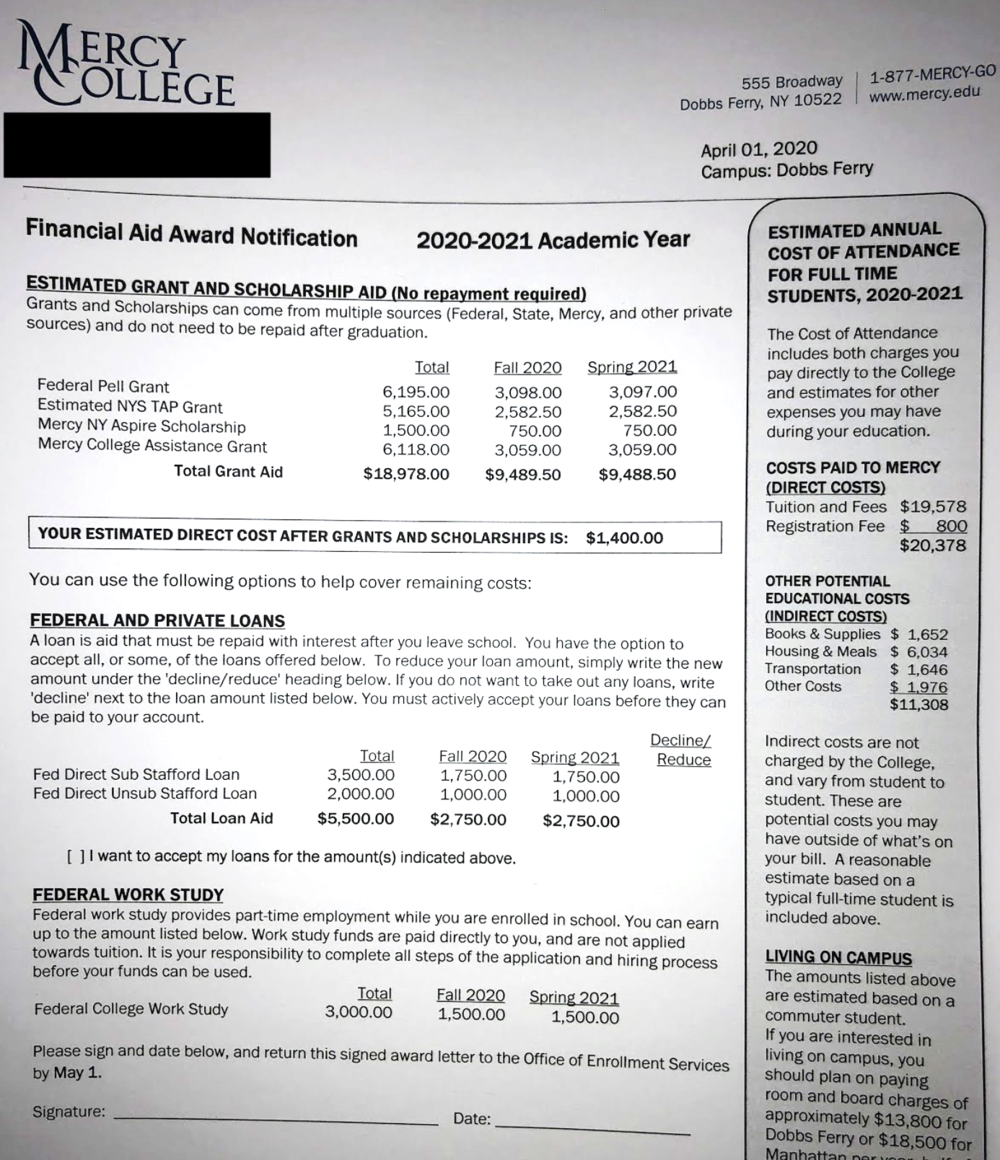

Mercy College

Miguel’s Mercy College letter added everything up for him, and calculated his direct cost as $1,400. However, it was very different from Alfred - it didn’t include housing, meals, books, or transportation in the total cost.

Miguel received $18,978 in grants, which appeared great since the total cost was just $1,400 more.

The sidebar of the award letter revealed the actual cost - $11,308 more than the cost of just tuition.

Miguel’s loans were exactly the same as at Alfred - $5,500 total, with $2,000 unsubsidized.

His work study was higher, with a generous $3,000.

Miguel’s total cost of attendance was $4,208 - much better than Alfred University, but also much higher than the $1,400 that the letter implied would be his family’s cost.

What do I need to look for in my financial aid award letter?

Before committing to a school, make sure you do each of the following:

Check whether housing, meals, travel, and books are included in the total cost of attendance.

Add up the total cost of attendance, including all of these things.

Subtract the free money (scholarships and grants), loans, and work study from the total cost of attendance. Ask your family whether this is an amount you can reasonably cover.

Look at your loans to make sure they don’t total more than $5,500 and be aware of how much is unsubsidized and will cost more than it says.

Use your common sense - don’t let the jargon trip you up!

If something is unclear, just ask! That’s literally what the financial aid office is there for, and it won’t hurt your child’s standing if you have questions.