College Application Fee Waivers: Are You Eligible?

Determine if you are eligible for college application fee waivers!

Find out how college application waivers are distributed to students!

Learn about the different types of fee waivers available for students.

Why are fee waivers necessary?

There are hidden fees associated with higher education. These may include the college application fee, SAT fee and travel expenses to visit college campuses. These additional expenses pile onto all the other outstanding expenses associated with continuing your post-secondary education. Applying to colleges across the U.S is a costly task. According to US News Weekly, the median cost of applying for one college is approximately $50. Generally, universities charge an application fee for students and the most prestigious universities have higher application fees that surpass the average amount.

Before you are accepted into your desired university, knowing the cost of your college applications and the resources that are available, will reduce some of the money you will have to pay during the college application process. Applying to college is extremely expensive and can accumulate to hundreds and thousands of dollars, before you attend any institution and each college you apply to has a cost that ranges from $45 - $100.

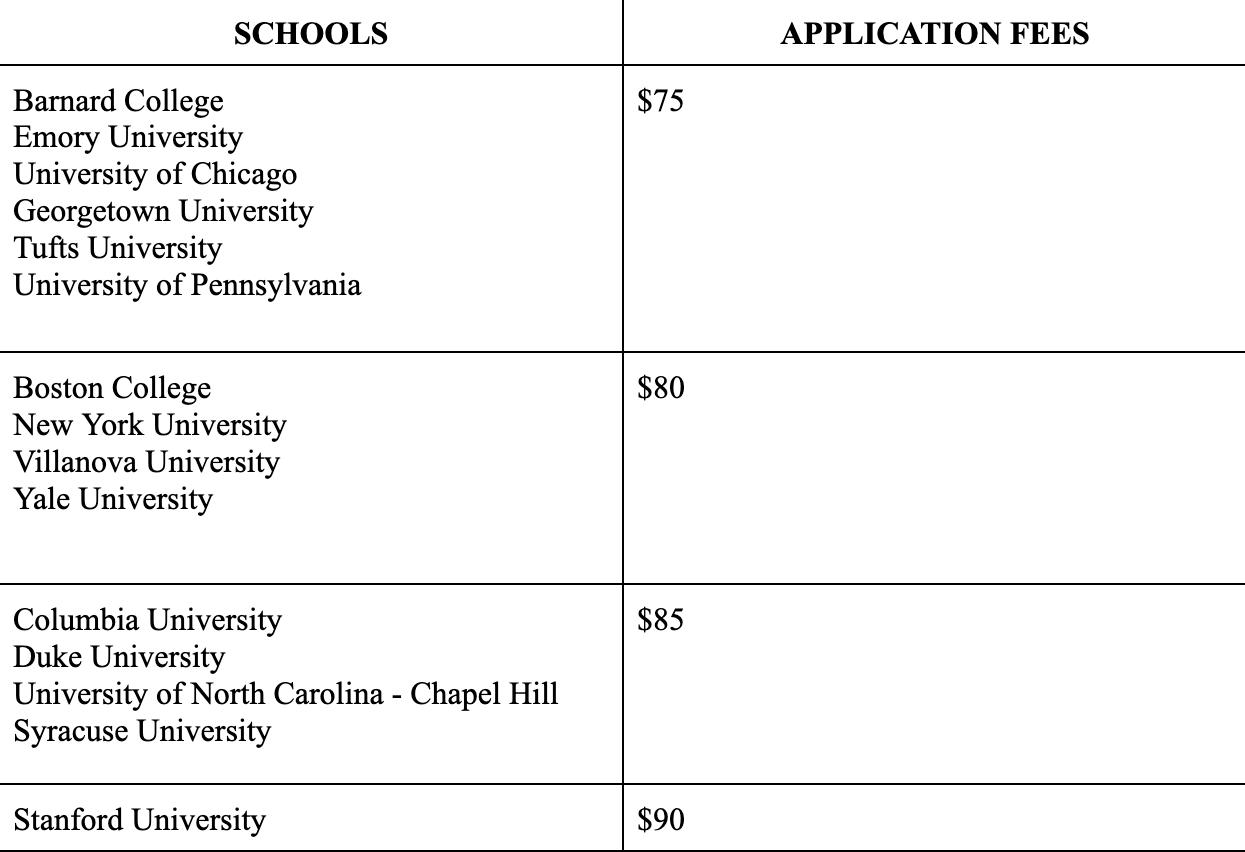

The table below listed fifteen colleges and universities across the United States with the highest college application fee. This is not a reflection of the application cost for all institutions; many colleges and universities have application fees that are lower and more affordable than these “esteemed” institutions and other colleges simply do not have an application fee.

To alleviate some of the additional costs when applying for college admissions, fee waivers are available. There are different types of fee waivers that students are eligible for and are accessible for applicants whose college applications place more financial distress on their families. Some of these waivers include: ACT/SAT waivers, college application waivers and financial aid application waivers for students who meet the eligibility criteria.

Two year colleges are free to apply to; therefore, fee waivers are not necessary for these college applications. For four year colleges and universities that have application fees, many students who qualify for college entrance fee waivers such as the ACT or SAT, are also eligible for college application fee waivers.

If you are not eligible to receive fee waivers, there are some ways to cut the cost of your college application cost. This includes applying to state schools or narrowing down your list of potential colleges, to avoid the high application costs. Some colleges will waive application fees if you apply early or attend campus tours and events organized by that school. Similar to two year colleges, there are many four year colleges with no additional application expenses. There are several schools where you can apply for free.

What circumstances qualify students for fee waivers?

There are certain indicators that show which students are eligible for fee waivers for the additional financial support. For all fee waiver programs students must meet one of the following requirements:

You qualified for an SAT/ACT test waiver

You are enrolled in or are eligible for the National School Lunch Program

Your family receives public assistance or welfare benefits

Your household income is within the USDA Food and Nutrition Service’s income eligibility guidelines

You’re enrolled in a federal or state program that assists low-income families, such as Upward Bound

You are a ward of the state or have been orphaned

You live in federally subsidized public housing, are in foster care or are homeless

Different types of Fee Waivers available for students:

Exam Fee Waivers: SAT and ACT

College Entrance exams can be covered by fee waivers. The SAT and ACT fee waivers allows students to sit in for two free SAT exams and have two chances to access answer services. If you plan to sit for the SAT or ACT again, the exam cost will be solely up to you, since additional fee waivers for standardized exams are not given. The fee waivers provided for the SAT or ACT exams, can also qualify students for the College Board’s college applications fee waiver. Unlike the exam waivers that only provide two free exams, students that receive fee waivers for the SAT can apply to as many colleges and universities across the country for free. These waivers can be used multiple times for different institutions.

According to the College Board Website, students can accept fee waivers by:

Signing into your College Board account. You can create an account if you don't already have one.

On your profile, click “My SAT.” You can go right to the “My SAT” page if you've only used your College Board account for the SAT.

On the My SAT page, accept your fee waiver. Review the terms of the eligibility, if you've been marked as eligible, then click Continue. Enter a 12-digit fee waiver code if you have one, and then click Submit.

Homeschooled students can get fee waivers by contacting a local high school counselor. You'll need to show proof of eligibility, such as tax returns or proof of participation in a financial aid program. International students are only eligible for exam fee waivers if they are residing or testing in the U.S or in a U.S territory.

College Application Fee Waivers

1. Common App Fee Waivers

The Common App fee waivers are designed to help students with economic needs, apply to colleges and universities for free. Applying to colleges is an expensive process, where students have to pay a fee with each application they send to different schools.

The Common App fee waiver is applied to all your college applications. To request a fee waiver, go to the Common App Fee Waiver section of your Profile. After you've completed that section, we'll have your counselor fill out a fee waiver form to confirm your fee waiver request.

Your school counselor will need to verify your information in order to secure a fee waiver, so reach out to them for assistance. Similar to the Common Board fee waivers, the Common App requires school counselors to verify the financial information you submit is correct and a clear determinant of your eligibility for fee waivers.

2. NACAC

The National Association for College Admission Counseling (NACAC) is another organization that provides application fee waivers to low-income students. You can only apply to a limited number of schools with this fee waiver. Typically the maximum is four, but additional waivers can be given depending on financial need or special circumstances.These fee waivers were provided to students through a guidance counselor, but COVID-19 has changed the way this waiver is submitted. The policy now states, “Students or counselors can submit the waiver directly to colleges and universities if getting both signatures is a difficulty,” making it easier for students to gain access to this fee waiver.

Learn more about the NACAC application fee waiver and the steps students will take to submit their NACAC application.

Financial Aid Fee Waivers

Financial aid applications

The Free Application for Federal Student Aid, or FAFSA, is a free system to fill out and is used by students to determine their federal student aid, grants, scholarships, work-study, and student loans. When navigating the FAFSA portal, you can choose up to ten schools to receive the results of your FAFSA application.

For access to state and institutional aid, some of the schools on your list may require the CSS Profile. The CSS Profile, unlike the FAFSA, costs $25 to submit to one school. However, you may be eligible for a CSS Profile fee waiver, which would cover these costs. If your household earns up to $100,000 per year, you have qualified for a SAT fee waiver or you are an orphan or ward of the court under the age of twenty-four, the CSS Profile is free. By completing the CSS Profile application, students can apply for institutional help at hundreds of colleges, universities, professional institutions, and scholarship programs online. For more information on the college admissions process, and navigating college, check out our blog: https://www.socraticssummeracademy.com/blog